“It is difficult to get a man to understand something, when his salary depends on his not understanding it.”

Upton Sinclair

"It is important to bear this in mind, because it tends to knock down the assertion that the current financial crisis is somehow an act of God, something that just happened. There was an intent to subvert the regulatory process, to increase leverage beyond what has long been known to be prudent, and to engage in systemic fraud with a group of enables and agencies, such as the ratings firms, in order to reap fabulous personal profits for a small group at the expense of the many.

There was planning, premeditation, malice aforethought. They may not have intended to harm; they just did not care. They really truly did not care, if they got theirs.

Until the banks are restrained, and the financial system reform, and balance restored to the economy, there will be no sustained recovery.

And there can be no better start than to stop the gambling with the public money that is the core of the existing US banking system. The parallels with organized crime and the subversion of the public interest through graft and corruption are compelling. And one thing we must accept is that the financiers will never be able to reform themselves, to regulate themselves, to even tell the truth overmuch about regulation while they are still 'in the game.' It goes against their very nature, their creed, the rules of their profession. They keep what they kill, and everything that is not theirs is fair game."

Jesse, Restoring Glass-Steagall, 28 October 2009

"Successful crime is dignified with the name of virtue; the good become the slaves of the wicked; might makes right; fear silences the power of the law."

Lucius Annaeus Seneca

“Those entrapped by the herd instinct are drowned in the deluges of history. But there are always the few who observe, reason, and take precautions, and thus escape the flood. For these few gold has been the asset of last resort.”

Antony C. Sutton

Just another day in the Pax-American Metaverse.

The FOMC raised interest rates the expected 25 bps.

And in the end Wall Street read this as dovish, and rallied to beat the band, going out near the highs.

The NDX set a new 'third high.'

The SP 500 was lagging and failed to set a new high.

The Meta stock was soaring after hours dye to 'not as bad' as expected results.

The Dollar slumped hard.

Gold and silver rocketed higher.

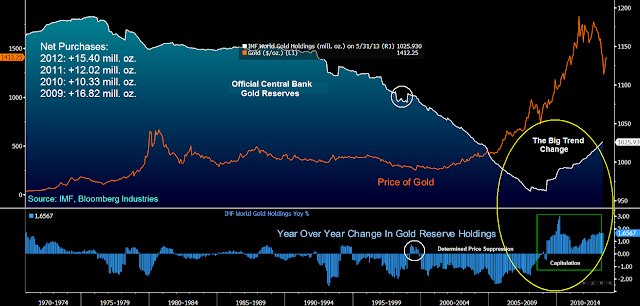

While stocks were soaring the Metaverse, back in the real world: Central Banks Buy the Most Gold since 1967

And the times, they are a-changing.

Why didn't the spokesmodels, chief strategists, breathless Mahoneys, and sock puppets talk about this historic development, which has been slowly unfolding since before 2009??

Yeah, buddy...

Non-Farm Payrolls on Friday.

Let's see if bully can keep it up.

With these jokers its always easy come, easy go.

Have a pleasant evening.